As a founder, the psychological value you attribute to your company in the early stages of its existence is often higher than what is perceived as the fair market value by others. For instance, the price that potential investors or acquirers put on your company can be quite disappointing.

The first time my wife and I asked an accounting firm for a valuation report assessing how much our company was worth, we were extremely unhappy with the outcome, but it was an excellent learning experience to discover what was missing in our company to create value.

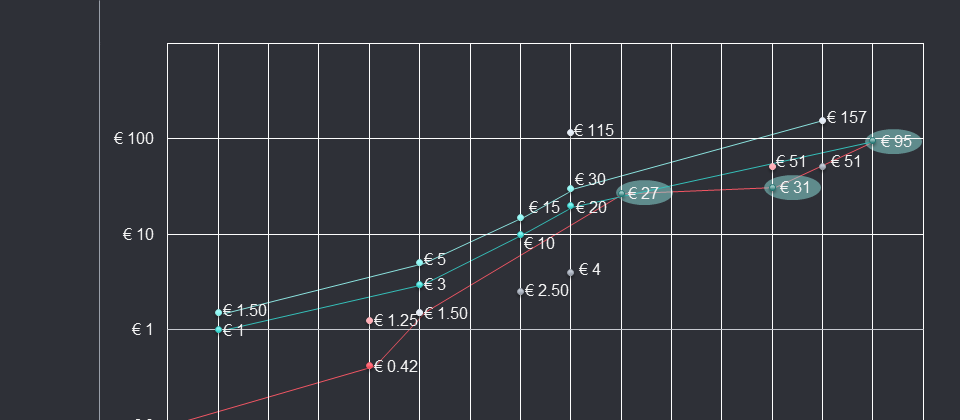

We went into M&A mode twice. The first time to make the company "investor ready"; the second time to actually sell the company. When an M&A consultant calculated the target price, there was a difference of 100 million euros between the worst case and the best case scenario.

Eventually, we sold the company in three chunks. We sold the first package of shares at a valuation of 27 million euros; we sold the remainder of our shares at a valuation of 95 million euros.

If you're interested in this case story, watch my video "The Dark Magic of Start-up Valuation" or read the transcript of the video on the Entreprenerd web site.

Top comments (0)