Today, we are excited to “Open-Source” a new data resource that continuously tracks and analyzes every COSS company that has gone public since the Red Hat and VA Linux IPOs in 1999 and 2000.

Over the coming weeks and months, we will be launching an interactive application that provides even greater data querying, visualization and analysis capabilities.

For a retrospective and current analysis, we will also offer insights into how these COSS companies have performed pre-IPO, during-IPO and post-IPO (many were acquired or merged post-IPO).

Before we explore the actual data, let’s cover our motivations for creating this new resource for the growing COSS ecosystem!

Introducing the COSS IPO Data Sheet:

Motivations

In 2013, we started to maintain a list of every COSS company that has ever reached $100M in annual revenue. As the $100M revenue COSS index has grown, it has clearly become the De facto data resource to educate founders, investors and builders about the profound growth of this category:

https://twitter.com/LefterisJP/status/1267534569193996288

https://twitter.com/arungupta/status/1105619224066613248

https://twitter.com/VinIyengar/status/1320165023080038400

https://twitter.com/nic__carter/status/1181200655312211968

https://twitter.com/gregosuri/status/1161017262641303552

We are in the process of relaxing the $100M revenue constraint in this index down to $10M~, including far more private up-and-coming COSS companies than ever before. Expect this list to grow from 50~ to 100+ and with a much wider range of rich data points!

Over the last 7 years from 2013 to 2020, we have seen this “large-cap COSS index-of-sorts” grow along the following dimensions:

- Number of companies listed: from 4~ to 50~!

- Size: from $10B~ to $175B+ in total category value

- Diversity: Instead of 90%+ of the value concentrating on just one or two companies a decade ago, there are now 50+ COSS companies with an average value of $3B+ and growing rapidly

- IPOs: The number of private COSS startups that have exited the private finance markets (VC/privately owned) and entered the public finance market (going through an IPO process with bankers and being listed on a major public stock exchange like the NASDAQ) has grown from ~5 to 15+!

We believe this data in the COSS Index represents more than enough data to convince us of a trend:

More COSS companies will enter the public markets via many mechanisms (DL IPO, SPAC IPO, traditional IPO, etc) over the next decade than have gone public since the year 2000. We expect at least 25 more COSS IPOs by the year 2030, in addition to the 15 that have already gone public.

Why do we believe this? One primary reason: The fast growing size of the $100M revenue COSS index (still largely private companies) clearly indicates that many private COSS vendors are ready to go public now!

Specifically, GitLab, HashiCorp, Odoo, Databricks, Conflent and others. All of these companies have reached at least $100M in revenue and several have achieved $300M+ in ARR.

Data

Since the founding of OSS Capital in 2018 and our research going back to 2013, we have strongly believed that COSS companies are fundamentally different and should be recognized as such, as compared to fully proprietary companies. At large, it is clear that many more private market investors are starting to recognize this, too, as evidenced by the notable and recent (over the past 1 year) wave of VC-driven COSS frameworks, blogs, thought pieces and more:

- Andreessen Horowitz: https://a16z.com/2019/10/04/commercializing-open-source/

- BVP: https://www.bvp.com/atlas/measuring-the-engagement-of-an-open-source-software-community

- https://www.bvp.com/atlas/roadmap-open-source/?from=feature

- Runa: https://runacap.com/ross-index/

- Venrock: https://ethanjb.medium.com/building-a-commercial-open-source-company-part-1-community-market-fit-3069dcac4ebd

- Atomico: https://medium.com/atomico/atomicos-take-on-open-source-5-reasons-to-build-an-os-company-in-europe-now-6dd443a730b6

- GGV: https://www.forbes.com/sites/glennsolomon/2020/10/13/finding-trillions-in-the-clouds-how-open-source-companies-can-win-in-a-world-dominated-by-amazon-microsoft-and-google/?sh=7cde0d5b688f

- Accel: https://www.accel.com/noteworthy/the-future-of-open-source-launching-the-open100

- 5Y Capital: https://github.com/chenzhepeter/ChinaCOSS

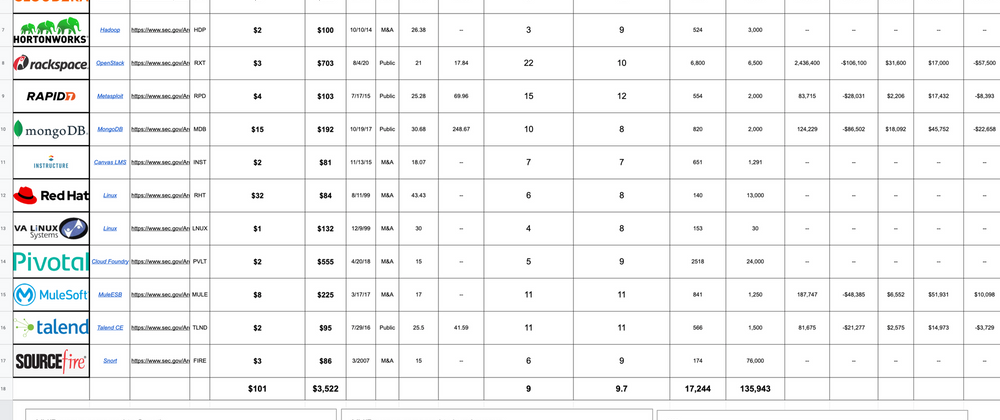

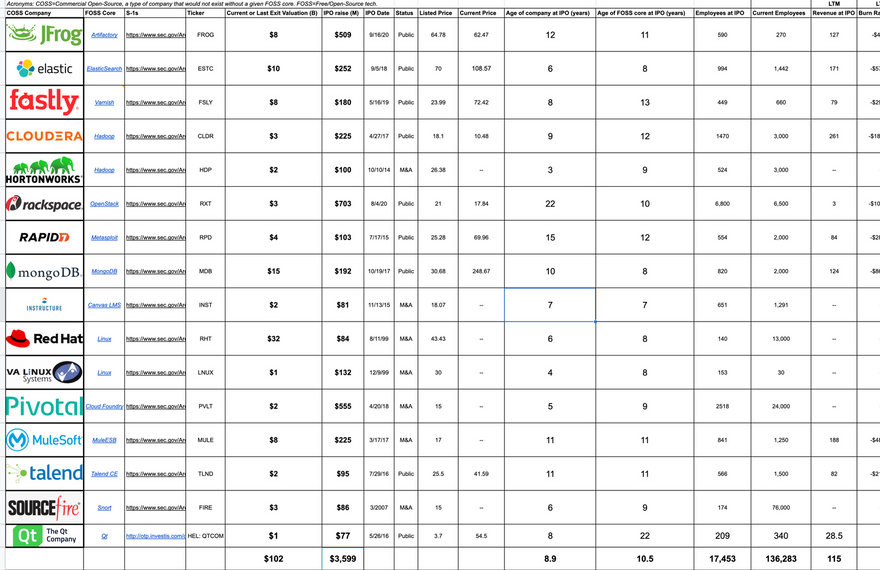

Here are the data points covered in the COSS IPO Dataset which will provide the basis for extensive analysis in subsequent writing and blogs from here:

- COSS Company

- FOSS Core: The Open-Source technology that the COSS company is based on.

- S-1s: Links to the red herring filings for each company.

- Ticker: Acronym for the public listing when public.

- Current or Last Exit Valuation (B): Many of the 15 COSS companies who have gone public were subsequently acquired and continue to grow inside larger parent organizations (e.g. MuleSoft to Salesforce, Sourcefire to Cisco, etc)

- IPO raise (M): How much capital was raised during the IPO?

- IPO Date: When did the company IPO?

- Status: Still public, or acquired?

- Listed Price

- Current Price

- Age of company at IPO (years)

- Age of FOSS core at IPO (years)

- Employees at IPO

- Current Employees

- Financial Metrics (We will add more over time):

- Revenue at IPO

- Burn Rate at IPO

- Stock comp

- Deferred revenue

- Adjusted burn

- Burn as % of revenue

- MV at IPO (M)

- Growth MV/revenue

- Top 3 equity owners at IPO

- FOSS emphasis / highlights in S-1: How much did the S-1 filing discuss Open-Source or highlight the FOSS core as a key part of the COSS company strategy, positioning, etc?

Latest comments (0)