COSS Weekly, Issue #20: March 14th, 2021

Welcome to the twentieth issue of COSS Weekly, the global Commercial Open-Source ecosystem newsletter brought to you every week by Joseph Jacks and the team at COSS.Community, OSS Capital and Open Core Summit.

Each week, we neatly summarize the latest happenings in COSS, often including objective commentary across primarily the following areas: Funding, Content, Liquidity, Data, Markets.

💰 COSS Funding

Tetrate, provider of an enterprise-ready service mesh, announces $40M Series B led by Sapphire VC. Link

Insight Partners, Accel, and Cervin Ventures discuss why they invested in Privacera's $50M Series B. Link

Aqua Security, the pure-play cloud native security leader, announces $135M Series E led by ION Crossover Partners, and crosses $1B in valuation. Link

Hugging Face, building an open-source library for NLP technologies, announces $40M Series B led by Addition. Link

Privacera, the cloud data governance and security leader from the creators of Apache Ranger, announces $50M Series B led by Insight Partners. Link

📚 COSS Content

The Future of Business Intelligence is Open Source by Maxime Beauchemin. Link

Semaphore Uncut: Open Source Business Models with Alex Ellis. Link

Open Product Recipe: How to challenge a closed incumbent with an open source product by Erlend Sogge Heggen. Link

Join GGV Capital Evolving Enterprise on Thursday, March 25th, and check out the panel featuring Glenn Solomon (Managing Partner at GGV Capital), Dave McJannet (CEO at Hashicorp), and Neha Narkhede (Co-founder and CEO of Confluent). Link

Max Lynch (Co-founder/CEO of Ionic): Building an open source company is a journey in slowly realizing that your best customers and users *want* you to be commercial and charge for things. Because otherwise, you're just like every other team doing open source: no support, no enterprise-specific software, no guarantees. [Discussion continues] Link

Kurt Daniel (CEO of Ubersmith): MongoDB maintained strong total revenue growth of 38% (and subscription revenue of 39%). And its Atlas revenue actually accelerated from 61% to 66% (!). Link

JJ (OSS.capital, COSS.community): Roblox created a digital market economy for millions of game developers to commercialize their creations: empowered and encouraged to monetize and be fairly rewarded. GitHub should implement the same playbook but for open source! Link

Kevin Xu (Interconnected): This news is quite important. MIPS (A once-prominent chip architecture & company) will no longer make MIPS chips, but consolidate around the open source RISC-V. MIPS IP is mentioned as a key ingredient to China's "Made in China 2025" plan. Link

Syrus Akbary (Founder and CEO of Wasmer): If I ever had to explain why Wasmer became a billion-dollar company... Link

David McJannet (CEO of HashiCorp): Congrats to Roblox who are poised for a milestone. Great example of our role "enabling the multi-cloud operating model" - here across hybrid AND edge. Terraform, Vault, Consul, Nomad. [Links to Hashicorp case study and integration story with Roblox]. Link

JJ: Huge congrats to all my friends at Talend on their $2.4B outcome to Thoma Bravo today. Link

Elastic License 2.0 and the Evolution of Open Source Licensing by Heather Meeker (Partner at OSS.Capital) Link

JJ: We are soon publishing the 1st State of COSS including our well-known $100M ARR COSS Index (OSS.Cash), latest $COSS ETF news, all-time IPO analysis, PE/VC funding data AND the inaugural COSS benchmarking research platform across 500 + co's! Stay tuned. Link

JJ: Bessemer Venture Partners has been tracking SaaS since 2011. OSS Capital has been tracking COSS since 2013. Today, SaaS is valued at around $2.2T~ ...! While COSS is valued at around $300B~. These are fundamentally different categories, but some overlap qualities often lead to conflation. (Thread continues). Link

Red Hat Community: Season 2 of Open Source in Business is coming soon, but while you wait, here is a new highlight clip on Managing Open Source Supply Chains from season 1! Link

JJ: Software is eating the world, but knowing how to actually spot a software company is a highly valuable skill... Open source is eating software even faster, and knowing how to spot a COSS company is an even more valuable skill. Link

State of Open: The UK in 2021, OpenUK Report. Economic impact of open source software may be up to £43 Billion on GDP in the UK, compared to up to £84.15B in European Union. Link

Entreprenerd: Commercial open source software is the best guarantee for the production of software that is useful, innovative, and of high quality, and at the same time sustainable, accessible, and affordable. Link

How I earn a living selling my open source software by nemiah. Link

70+ open-source clones of popular sites like Airbnb, Amazon, Instagram, Netflix, Tiktok, Spotify, WhatsApp, Youtube, and more, from Gourav Goyal. Link

Semiconductor Design Consolidation: MIPS -> RISC-V. Link

Liyas Thomas (Maker of Hoppscotch): Shoutout to OSS Capital for becoming Hoppscotch's Unicorn Sponsor. @asynchio - your contribution makes a difference. Link

Commercial Open Source Software - learnings at firstminute capital by Sam Endacott (Principal, firstminute capital). Link

A Framework for Open Source Evaluation: The question is not any longer if a project is open source or not, the question is how open a project is by Bilgin Ibryam Link

JJ: "Cloud Computing" turns 15 today. Link

Talend - the Next Cloud Success Story? by Mortiz Plassnig Link

💸 COSS Liquidity

Talend to be Acquired by Thoma Bravo in $2.4 Billion Transaction. Link

SUSE prepares for multi-billion Euro IPO. Link

Couchbase files for IPO that could value it at as much as $3B. Link

📊 COSS Markets

| Ticker | Name | Market Cap | Total Revenues/CAGR (1Y TTM) | Total Revenues (LTM) | Last Price | Total Return (1Y) | 1-Day % |

| FSLY | Fastly Inc. | $8.61B | 46.53% | $267.16M | 64.84 | 202.28% | -0.99% |

| CLDR | Cloudera Inc. | $3.66B | 17.53% | $854.41M | 14.66 | 63.07% | -2.01% |

| ESTC | Elastic N.V. | $10.44B | 49.18% | $510.57M | 123.55 | 72% | 0.49% |

| MDB | MongoDB Inc. | $19.49B | 41.5% | $542.9M | 308.17 | 93.43% | -6.13% |

| RPD | Rapid7 Inc. | $4.17B | 28.25% | $389.98M | 77.78 | 59.29% | -1.36% |

| TLND | Talend S.A. | $2.09B | 16.18% | $276.01M | 51.18 | 48.74% | 3.94% |

| QTCOM | Qt Group Oyj | $2.17B | 44.45% | $72.54M | 76.2 | 252.7% | -4.03% |

Data from Koyfin

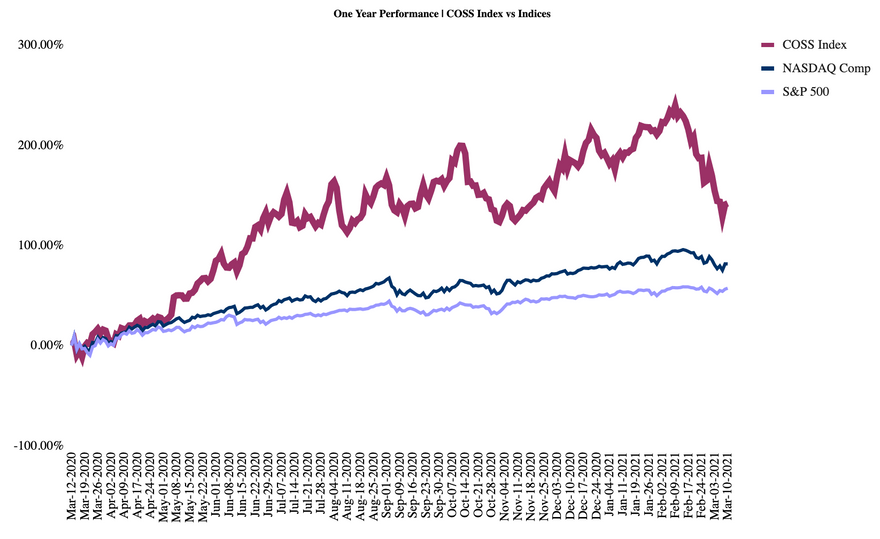

Performance analysis courtesy of Shawn Cherian and the OSS Newsletter:

To track the performance of COSS companies, we’ve created an equal-weighted index comprised of public names including: MongoDB, Elastic, Talend, Cloudera, Rapid7, Fastly and Jfrog.

Over the last year, the COSS Index significantly outperformed the benchmarks:

• COSS Index +148.09%

• NASDAQ +86.05%

• S&P 500 +58.80%

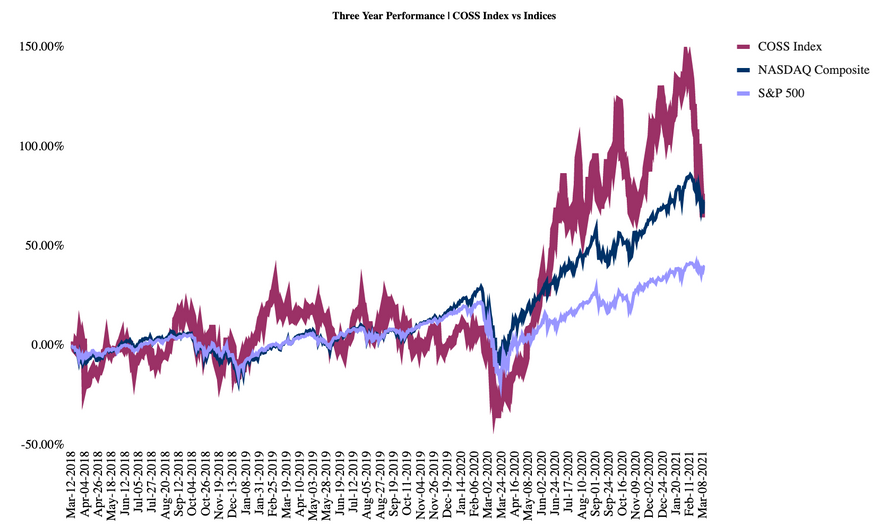

Three Year Performance

• COSS Index +80.73%

• NASDAQ +76.57%

• S&P 500 +41.55%

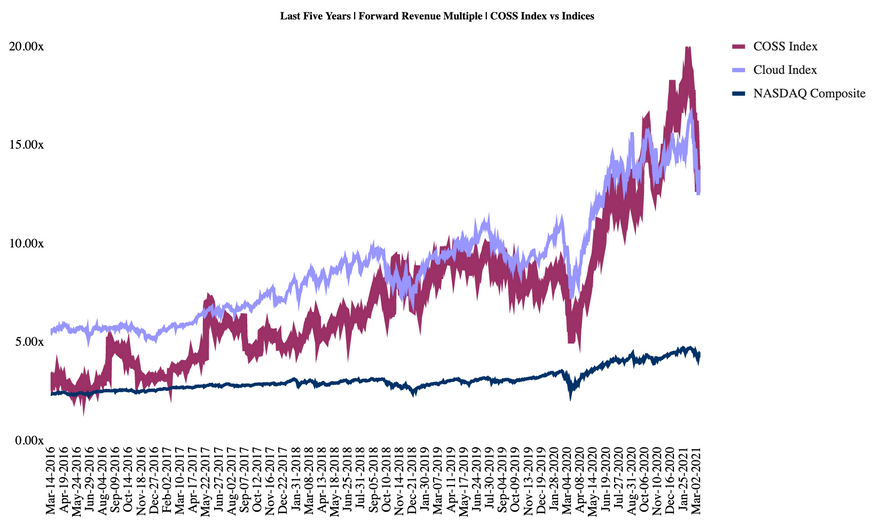

Five-Year Average

• COSS Index: Current Multiple 7.3x | Five-Year Mean: 6.6x

• Emerging Cloud Index: Current Multiple 8.8x | Five-Year Mean: 8.6x

• NASDAQ Composite: Current Multiple 3.1x | Five-Year Mean: 2.9x

📈 COSS Data

- 🌐 YC COSS: For the first time ever in 2020, 15~ COSS startups have gone through YC in a single year representing 30%+ of the total (50~ since 2006). Our YC COSS dataset tracks and provides granular data on the growing but still small COSS YC alumni.

- 🏦 COSS PE Funding: This dataset tracks the latest funding events for all stages of COSS companies, mostly in private markets, for 2020-2021+.

- 📊 COSS Index: The well-known COSSI sheet for the exclusive $100M+ revenue club of COSS companies. New data points and growth happening weekly.

- 🌩️ AWS COSS: List of COSS services on AWS. Continuously evolving. We plan to offer similar datasets for Azure, GCP, and other major clouds.

- 📈 COSS IPO: Analysis of every COSS IPO since 1999.

COSS Weekly is brought to you via COSS Community and OSS Capital (the first and only COSS-dedicated early-stage investor platform for COSS founders)

Top comments (0)