COSS Weekly, Issue #22: March 28th, 2021

Welcome to the twenty-second issue of COSS Weekly, the global Commercial Open-Source ecosystem newsletter brought to you every week by Joseph Jacks and the team at COSS.Community, OSS Capital and Open Core Summit.

Each week, we neatly summarize the latest happenings in COSS, often including objective commentary across primarily the following areas: Funding, Content, Liquidity, Data, Markets.

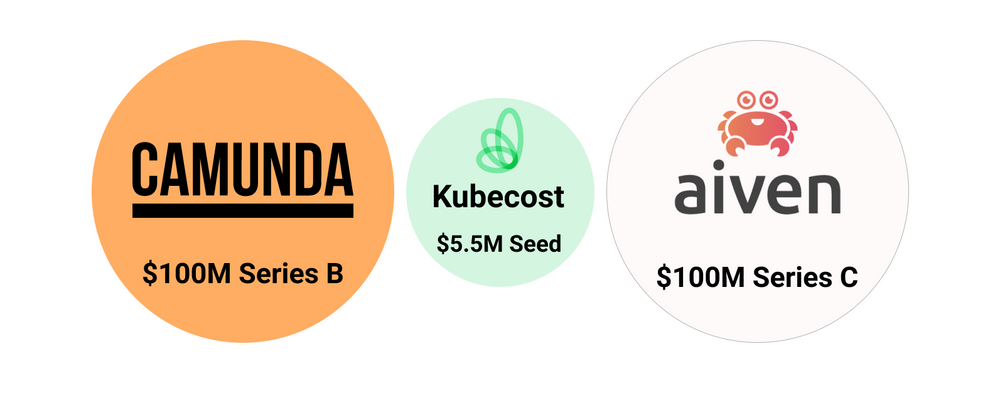

💰 COSS Funding — $205.5M This Week

Camunda, an open-source RPA platform, announces $100M Series B led by Insight Partners. Link

Aiven, combining the best open source technologies with cloud infrastructure, announces $100M Series C led by Atomico. Link

Kubecost, giving engineers visibility into spend and resource efficiency in Kubernetes environments, announces $5.5M seed led by First Round Capital. Link

📚 COSS Content

JJ: Based on the sustained pace over the last 6 months ($175-300M/week), the COSS category is on target to raise a truly staggering >$10 BILLION (!) in PE funding across all private startup stages in 2021. This would nearly double the TOTAL amount raised since 1995. Link

nixCraft: Richard Stallman (RMS) announcing his return to the FSF's Board of Directors (Video). Link

JJ: We very closely track (data-driven) how much the public Cloud is transforming to COSS. Specifically for AWS, nearly 20~ COSS services have been launched just over the last 6 years...! COSS services on AWS now represent 10%~ of the total (200~ services). And growing. Link

JJ: In 2020, COSS co’s raised $2.7B~ in total VC (all stages), nearly doubling 2019. As of 3/23/21, $2.8B~ has already been raised, surpassing ALL of 2020 in less than 90 days. And these are just the publicly disclosed deals. Link

How to build a business around Open Source? by Tomasz Karwatka (Co-founder of Vue Storefront) Link

The Deck We Used to Raise Our Seed with Accel in 13 Days from Airbyte. Link

Plausible Analytics: Just reached $200k ARR and 2531 subscribers! Link

Jamin Ball (Partner at Altimeter Capital): Net retention is one of my favorite SaaS metrics. As Q4 earnigns season comes to a close, we can look back at all the cloud companies to report the metric. Anything >130% is top decile. (JJ: The top 5 COSS players listed, TLND, JFROG, FSLY, MDB, ESTC, are top quartile at 121%) Link

Jon Sakoda: This is a big announcement - Cisco is now selling Hashicorp's Terraform Cloud offering on its global price list. This move is timely as both companies are uniquely positioned to help customers avoid lock-in to any one particular cloud vendor. Exciting news! Link

The Dark Magic of Start-Up Valuation by Bruno Lowagie (a.k.a. @Entreprenerd21) Link

Launching the Two Sigma Ventures Open Source Index by Vinay Iyengar. Link

Glenn Solomon: “The product driven growth model that has worked for Saas services has its origins in open source community dynamics” per @confluentinc cofounder @nehanarkhede along w/ @HashiCorp’s CEO @davidmcj at @GGVCapital Evolving Enterprise. Link

Sam Ramji: Data Visualization, Democratization, and Javascript: How millions of web developers are changing how we experience data. Listen to @mmeckf explain the importance of data literacy and the shift to web-native for data collaboration. Link

Introducing Focalboard, an open-source alternative to Trello, Asana, and Notion. Link

Red Hat statement about Richard Stallman’s return to the Free Software Foundation board. Link

Building A Global Company from Day 0 with Clint Smith on the Company Building Webinar Series wtih Kevin Xu. Link

Piotr Karwatka (co-founder at Catch the Tornado): Investing in open source from a VC perspective? The new episode of @CTOtoCTO is out. I talk with @filipdames. A lot of insights including the story of Cherry engagement into @getsaleor. Link

Open source, not open contribution with Ben Johnson on The Changelog. Link

Kevin Xu: Firms who invest in developer-focused products or open source companies but have geo restrictions (e.g. NA only) make no sense... Open source is global. And developers are everywhere. Link

📚 COSS Liquidity

JJ: 11 yrs after founding, DigitalOcean has gone public! Yesterday, they raised $775M by selling 16.5M shares @ $44-47~ each on a $5B~ valuation. 2019 revenue was $255M, 2020 rev was $318M (at a gradually lowering loss of $3M~/mo). 570K+ customers. Built nearly entirely on OSS! Link

JJ: Kaltura is the latest COSS company IPO, raising $350M+ and targeting a $2.2B valuation. $120M + ARR. 670+ employees, still founder-run, started in 2006 and based on an open source core. Shares will be trading on April 1st 2021. Link

📊 COSS Markets

| Ticker | Name | Market Cap | Total Revenues/CAGR (1Y TTM) | Total Revenues (LTM) | Last Price | Total Return (1Y) | 1-Day % |

| FSLY | Fastly Inc. | $7.58B | 45.10% | $290.87M | 66.16 | 268.58% | 1.10% |

| CLDR | Cloudera Inc. | $3.53B | 9.45% | $869.26M | 12.13 | 52.39% | 2.19% |

| ESTC | Elastic N.V. | $9.96B | 44.18% | $554.50M | 110.93 | 97.10% | -0.75% |

| MDB | MongoDB Inc. | $16.26B | 39.99% | $590.38M | 265.77 | 97.89% | -2.47% |

| RPD | Rapid7 Inc. | $3.90B | 25.86% | $411.49M | 74.06 | 74.79% | 0.22% |

| TLND | Talend S.A. | $2.07B | 15.98% | $287.47M | 64.00 | 205.34% | 0.14% |

| QTCOM | Qt Group Oyj | $2.33B | 44.45% | $72.54M | 87.20 | 385.79% | 0.69% |

| PRGS | Progress Software Corporation | $1.96B | 4.69% | $453.75M | 44.27 | 35.43% | 5.91% |

| FROG | JFrog Ltd. | $4.23B | 44.03% | $150.83M | 45.29 | - | 0.07% |

Data from Koyfin as of 3/26/21

📈 COSS Data

🌐 YC COSS: For the first time ever in 2020, 15~ COSS startups have gone through YC in a single year representing 30%+ of the total (50~ since 2006). Our YC COSS dataset tracks and provides granular data on the growing but still small COSS YC alumni.

🏦 COSS PE Funding: This dataset tracks the latest funding events for all stages of COSS companies, mostly in private markets, for 2020-2021+.

📊 COSS Index: The well-known COSSI sheet for the exclusive $100M+ revenue club of COSS companies. New data points and growth happening weekly.

🌩️ AWS COSS: List of COSS services on AWS. Continuously evolving. We plan to offer similar datasets for Azure, GCP, and other major clouds.

📈 COSS IPO: Analysis of every COSS IPO since 1999.

COSS Weekly is brought to you via COSS Community and OSS Capital (the first and only COSS-dedicated early-stage investor platform for COSS founders)

Top comments (0)