COSS Weekly, Issue #1: 💥September 25th, 2020

Welcome to the first issue of the COSS Weekly, the global Commercial Open-Source ecosystem newsletter brought to you every Sunday by Joseph Jacks and team at COSS Media, OSS Capital and the organizers of Open Core Summit.

For context, COSS (Commercial Open-Source) refers to any company that would not exist without the co-existence of a given Open-Source core technology…COSS is abstract and agnostic to any business model, license model, relationship between project < - > company or any other detail.

Why COSS Weekly? 💡

COSS as a company category is not truly “new”, given the founding creation of Ghostscript in 1988 and, of course, Red Hat in 1993.

However, the world has only recently been able to observe since 2010 a kind of very new “critical mass materialization” of COSS companies that have achieved a range of scalable ($50M+ and $100M+ revenue) business models.

Coinciding with this catalytically historical timeframe, the following major milestones have been reached, among many others:

COSS has grown 20X+ in aggregate value from only $10B~ (vastly attributable to a single company: Red Hat) to $200B~ today (attributable to now 50+ unicorns and many decacorns)

$4 Billion + in equity funding (from public and private markets) has been poured into all stages of COSS in just 2019 and 2020 (so far) alone

$90 Billion + in company exits, IPOs, liquidity events to-date, mostly since 2018

$18 Billion + in revenue annually is now generated by COSS companies

The founding and launch of the first COSS-focused fund and ecosystem category conference: OSS Capital

and Open Core SummitMore than 10 COSS companies now employ 1,000+ people each

Nearly 10 COSS decacorns now exist (companies worth $10B+ each)

Since November 2019, many major VC firms have established public statements and resources, services and value propositions targeted at COSS founders: A16z, BVP, Accel, Lightspeed and others

What To Expect? 🤔

If you are an enterprise buyer, founder, executive, investor, analyst, blogger and/or working in tech curious about learning about the intersection of Open-Source, capitalism and startups, COSS Weekly is tailor-made for you!

In this our first newsletter, we will be sharing all the major COSS news that happened in 2020. So, this will be a very heavy edition. Starting with our 2nd edition next Sunday, we will only include weekly events.

Each week, we will neatly summarize (designed for < 5 min of high-level consumption) and provide direct links on the absolute latest happenings in COSS, often including objective commentary across primarily the following four areas: Funding, Content, Liquidity, Data.

💰 COSS Funding: Stage-agnostic, Seed to Series Z financing events (VC and private equity)

📚 COSS Content:Learn from how enterprise customers are embracing COSS on the customer-side… how VC firms like GGV, BVP, a16z and many others are evolving and shaping their views on COSS...how founders share their insights on building COSS companies…+ more

💸 COSS Liquidity: M&A, IPOs + more

📈 COSS Data: This is a special data-driven section in our first issue introducing you to a number of data-driven resources we maintain that seek to quantitatively answer the following questions:

- How is the accelerator landscape evolving?

- How much money have COSS startups raised?

- Who are the largest COSS companies?

- How is AWS doing in COSS?

- Which investors are the most experienced in COSS?

🌐 YC COSS: For the first time ever in 2020, 15~ COSS startups have gone through YC in a single year representing 30%+ of the total (50~ since 2006). Our YC COSS dataset tracks and provides granular data on the growing but still small COSS YC alumni.

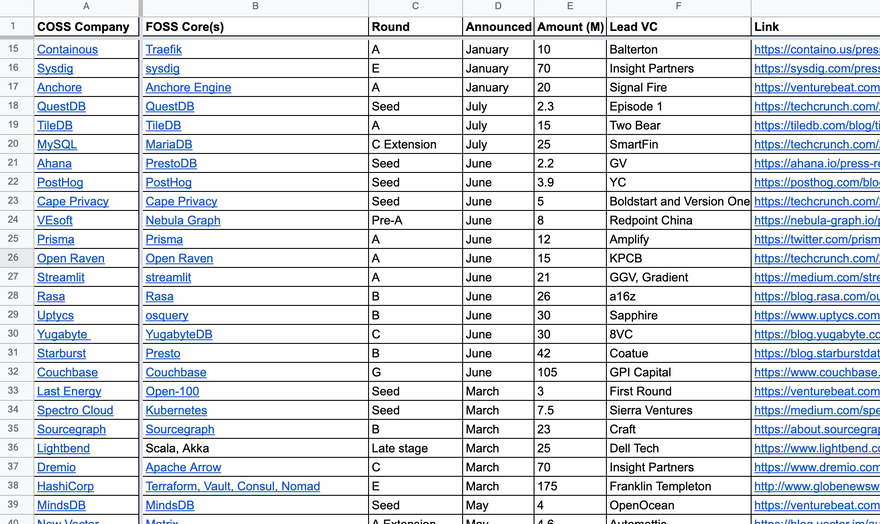

🏦 COSS Funding 2020: This dataset tracks the latest funding events for all stages of COSS companies, mostly in private markets. For 2020-2021+

📊 COSS Index: The well-known COSSI sheet for the exclusive $100M+ revenue club of COSS companies. New data points and growth happening weekly.

🌩️ AWS COSS: Lists COSS services on AWS. Continuously evolving. We plan to offer similar datasets for Azure, GCP and other major clouds.

💰 COSS Funding

Before reading the major funding highlights below (10+ VC deals > $40M each, for this issue only), here is the full COSS Funding 2020 sheet including all (undisclosed) funding events for 2020, large and small:

$250M Series E led by Coatue, April 2020, into: Confluent, founded in 2014, creators and commercializers of the Open-Source Apache Kafka project. Confluent is now 1,000+ people and is rumored to be approaching a $400M+ revenue run-rate next year. Link

$175M Series E led by Franklin Templeton, March 2020, into: HashiCorp, founded in 2012, creators and commercializers of the Open-Source Vagrant project initially, and now crucially the Terraform, Vault, Nomad, Consul and Packer technologies. HashiCorp has now also crossed 1,000+ people and is rumored to be approaching a $500M+ revenue run-rate next year. Link

$105M Series E led by GPI Capital, May 2020, into: Couchbase, founded in 2011, creators and commercializers of the Open-Source Couchbase project fka CouchDB/Membase in 2005. Link

$100M Series F co-led by Bain Capital and TVC, August 2020, into: Redis Labs, founded in 2011, creators and commercializers of the Open-Source Redis project. Link

$93.5M Series E led by Riverwood, April 2020, into: ForgeRock, founded in 2010, creators and commercializers of the Open-Source OpenAM, OpenIG, OpenIDM, and OpenDJ projects. Link

$90M late-stage “Series C” round led by Summit Partners, December 2019, into: Odoo, founded in 2005 in Belgium, makers of Java-based Open-Source enterprise application technologies in the ERP, HCM, CRM and more categories. Odoo is now 1,000+ people and well past $200M+ revenue. Link

$87M Series D led by Altimeter, May 2020, into: Cockroach Labs, founded in 2015, creators and commercializers of the Open-Source CockroachDB project. Link

$50M Series B led by Lightspeed, August 2020, into: Grafana Labs, founded in 2014, creators and commercializers of the Open-Source Grafana technology launched the same year 6 years ago. Link

$70M Series C led by Insight Partners, March 2020, into: Dremio, founded in 2015, creators and commercializers of the Open-Source Apache Arrow project released the same year. Link

$61M Series E led by SK hynix, August 2020, into: Sifive, founded in 2015, creators and commercializers of the Open-Source RISC-V computer architecture chip standard introduced in 2010. Link

$42M Series B led by Coatue, June 2020, into: Starburst Data, founded in 2017, commercializers of the Open-Source Presto technology launched by Facebook 6 years ago. Link

$40M Series B led by IVP, Feb 2020, into: Aiven, founded in 2016, commercializers of the Open-Source Apache Kafka, Apache Cassandra, Elasticsearch, PostgreSQL, MySQL, Redis, InfluxDB and Grafana projects. Link

📚 COSS Content

Timescale founder/CEO Ajay Kulkarni blogged about new permissive rights for their source available product built atop their Open-Source core. This represents some more evolutionary thinking about source available license models and commercializing OSS in the cloud. Link

Morningside VC’s (China-based and focused fund) Peter Chen created a GitHub page inspired by our COSSI dataset: Link

Matt Turk of FirstMark VC firm interviewed the great Mike Volpi of Index Ventures: Link

Newly acquired head of Corp Dev at late-stage COSS company CloudBees, Moritz Plassnig, has started blogging about COSS: Fundraising and Market Dynamics

Konstantin Vinogradov of Runa Capital published some perspectives on benchmarking some of the early promising COSS startups: Link

OSS Capital partner Kevin Xu blogged on Wired about the criticality of Open-Source itself for American Industry: Link

OSS Capital founder Joseph Jacks was interviewed by Managing Director David Linthicum of Deloitte: Link

GGV managing director Glenn Solomon and HashiCorp founder Mitchell Hashimoto podcast on remote-culture scaling through to 1,000+ people: Link

GGV managing director Glenn Solomon produced an incredibly rich series on Forbes covering his thoughts on the next $1 Trillion software wave: Link

BVP (Bessemer Venture Partners) shared their structured thoughts on COSS: Link

HeavyBit had Sid the co-founder of GitLab over to share about COSS: Link

TechCrunch interviewed some generalist VCs on how they see COSS: Link

Balderton Capital and GitPod have jointly created the OS4B conference and resource for COSS in Europe: Link

Accel has started producing mini online events with some of their COSS portfolio companies and others, while also creating a ranking list of categorizing COSS companies by layer-in-the-stack: Link

Red Hat is launching a new webinar series focused on Open-Source in the context of business, likely to include a lot of great COSS material: Link

Don’t forget to catch up on the creator series and much more that we published over the last year at COSS Media: Link

💸 COSS Liquidity

Well north of $3 Billion exchanged hands in liquidity land over the last year across 2 COSS IPOs and 10+ COSS M&A transactions:

JFrog, COSS company behind the Open-Source Artifactory software repository tool went public raising $400M~ in their IPO now trading at a $6.7B valuation: Link

Rackspace, COSS cloud provider and platform powered by the Open-Source OpenStack project went public raising $700M, currently trading and valuing the company at $3.6B: Link

SUSE acquires Rancher Labs, creators and commercializers of the Rancher project, for $600M+: Link

Vista Equity is rumored to have paid $400M+ for a controlling stake in Sonatype, COSS company behind the Open-Source Nexus repository project: Link

Equinix acquired Packet, creators of Open-Source primitives and tooling to run bare-metal platforms, for $335M: Link

Pure Storage acquires Portworx, creators of Open-Source middleware for storage driven containerized applications, for $370M: Link

Progress acquires Chef Software, creators and commercializers of the Open-Source Chef configuration management tool for $220M: Link

NVIDIA acquires the company behind Cumulus Linux, Cumulus Networks, for what is rumored to be a fair valuation close to what the company raised ($170M~): Link

PagerDuty acquired Rundeck, creators and commercializers of the Open-Source Rundeck runbook automation project, for $100M: Link

Splunk acquires Streamlio, early-stage COSS company built by the creators of Apache Heron, for an undisclosed amount, previously raising $7.5M from Lightspeed: Link

NVIDIA acquired Swiftstack, creators and commercializers of the Open-Source Swift storage project, for an undisclosed amount: Link

High-growth Brazilian challenger bank NuBank acquired Cognitect, creators and commercializers of the Open-Source Clojure programing language: Link

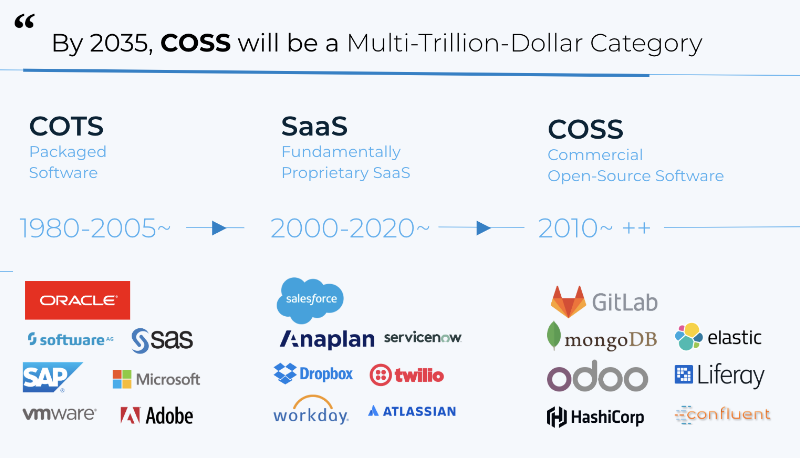

As usual, we end with this graphic depicting what we think the next Multi-Trillion-Dollar category in business will be:

COSS Weekly is brought to you via COSS Media, produced by OSS Capital (the first and only COSS-dedicated early-stage investor and platform for COSS founders.

Don't forget to sign-up for the second-annual FREE Open Core Summit 2020 Digital to meet with and learn from the leaders in COSS (enterprises, founders, investors, executives and more) on December 16-18th, 2020:

1 mission. 3 days. 10 tracks. 150+ speakers. 10,000+ attendees.

Top comments (0)