COSS Weekly, Issue #2: 💥October 25th, 2020

Welcome to the second issue of the COSS Weekly, the global Commercial Open-Source ecosystem newsletter brought to you every Sunday by Joseph Jacks and team at COSS Media, OSS Capital and the organizers of Open Core Summit.

Each week, we neatly summarize the latest happenings in COSS, often including objective commentary across primarily the following four areas: Funding, Content, Liquidity, Data.

(This issue includes all activity since the first issue. Rest assured, Issue #3 will resume a weekly cadence and only include events from the prior week.)

💰 COSS Funding

Eclypsium, an enterprise device security company, raises $13M from AV8, TransLink Capital, Mindset Ventures, Alumni Ventures Group, Ridgeline Partners, Intel Capital, Madrona Venture Group, Andreessen Horowitz, and Ubiquity Ventures. Link

Top developer entrepreneurs join forces to invest $2M in Earthly, a company reinventing software build tooling for the post-container era. Link

Grid AI announces $18.6M Series A with Index Ventures, Bain Capital Ventures, and firstminute. Link

Armory, built on open-source Spinnaker, announces $40M Series C with B Capital, Lead Edge Capital, and Marc Benioff, and previous investors. Link

FingerprintJS raises $4M to offer browser footprinting-as-a-service for any kind of application. Link

Sanity, tool for managing content flows on sites, raises $9.3M Series A with Threshold Ventures, Ev Williams, Adam Gross, Guillermo Rauch, Stephanie Friedman, and Monochrome Capital. Link

Temporal, building open-source microservices orchestration platform, announces $18.75M Series A with Sequoia Capital, Addition Ventures, Amplify Partners, and Madrona Venture Group. Link

Anyscale, creators of the Ray open-source Python framework for distributed computing projects, has raised $40M from NEA and Andreessen Horowitz.Link

Altinity, the largest enterprise ClickHouse services provider, launched its first cloud service and will fund further development with a $4M investment from Accel.Link

Solo.io, delivering API infrastructure to help enterprises manage modern application networks, announced a $23 million Series B co-led by Redpoint Ventures and True Ventures. Link

Pixie launches public beta and announces $9.15M Series A from Benchmark and GV. Link

Cube Dev, open-source company behind Cube.js, has raised a $6.2 million seed round to help developers write analytics applications for both internal and external users. Link

📚 COSS Content

Announcement of Keynote Speakers for Open Core Summit. Link

Glenn Solomon: How Open Source Companies Can Win In a World Dominated by Amazon, Microsoft, and Google. Link

Atomico: 5 Reasons to Build an OS company in Europe now. Link

In one year, Open Core Summit has grown by over 1,200%. Link

Odoo shares copy of 2020 strategy document, originally written in 2014. Link

Nick Schrock shares thoughts on AWS forking open-source project Checkly without attribution. Link

Ethan Batraski series on building COSS — Part 1: Community and Market Fit. Link

FreedomFi opens public beta of FreedomFi Gateway for those building LTE or 5G networks. Link

Runa announces Runa Open Source Startup (ROSS) index, highlighting top-20 fastest-growing startups by the metric of GitHub stars. Link

Scott McCarty (RedHat) post on product management for open-core companies. Link

Kevin Xu of COSS Media: 2 Things to Measure and Improve Open Source Community Sustainability. Link

Introduction to the Open Source Business Forum community and the future of open source in Europe. Link

How open-source software transformed the business world, and became vital for vertical markets and companies. Link

Completely community-driven, with no centralized ownership, Postgres has been the elephant in the room for more than 30 years. Link

Ockam details company roadmap from Zero-to-IPO. Link

What software companies can borrow from the open-source cloud playbook: Simplifying monetization with resource-based pricing, delivering immediate value and reducing complexity, and perfecting the free trial experience. Link

Camus Energy focused on industry collaboration through open-source software, announces grid orchestration project with VMware at VMware HQ in Palo Alto. Link

Building product offerings from open-source projects. Watch replay of discussion featuring Adam Jacob (CTO/founder of Chef) and Scott McCarty (product manager for OpenShift at RedHat). Link

With NVIDIA purchasing Arm, will the open RISC-V processor architecture gain momentum?Link

HashiCorp announces two new open-source projects: Waypoint for consistent developer workflows across any platform, and Boundary for simple and secure remote access to any system based on trusted identity.

Thoughts and questions from Andy Randall (VP Business Development at Kinvolk) on the business of open source. Link

Ross Mason, founder of MuleSoft, announces resignation from company and recounts the company's journey. Link

COSS companies on track to raise more than $3B in 2020, with more announcements and data to come. Link

💸 COSS Liquidity

Well north of $3 Billion exchanged hands in liquidity land over the last year across 2 COSS IPOs and 10+ COSS M&A transactions.

Twilio acquires Segment for $3.2B. Link

Kasten, a market leader for Kubernetes backup and disaster recovery, acquired by Veeaam. Link

Element, the company behind Matrix, has acquired developer-focused chat platform Gitter from GitLab. Link

VMware announces intent to acquire SaltStack — a pioneer in building intelligent, event-driven automation software. Link

Cisco enters agreement to acquire Portshift, focusing on cloud native application security capabilities and expertise for containers and services meshes for Kubernetes environments. Link

Following Chef's acquisition by Progress, Miah Johnson (former Senior Infrastructure Engineer) shares news of upcoming layoffs to former Chef staff. Link

📈 COSS Data

- 🌐 YC COSS: For the first time ever in 2020, 15~ COSS startups have gone through YC in a single year representing 30%+ of the total (50~ since 2006). Our YC COSS dataset tracks and provides granular data on the growing but still small COSS YC alumni.

- 🏦 COSS Funding 2020: This dataset tracks the latest funding events for all stages of COSS companies, mostly in private markets. For 2020-2021+

- 📊 COSS Index: The well-known COSSI sheet for the exclusive $100M+ revenue club of COSS companies. New data points and growth happening weekly.

- 🌩️ AWS COSS: List of COSS services on AWS. Continuously evolving. We plan to offer similar datasets for Azure, GCP, and other major clouds.

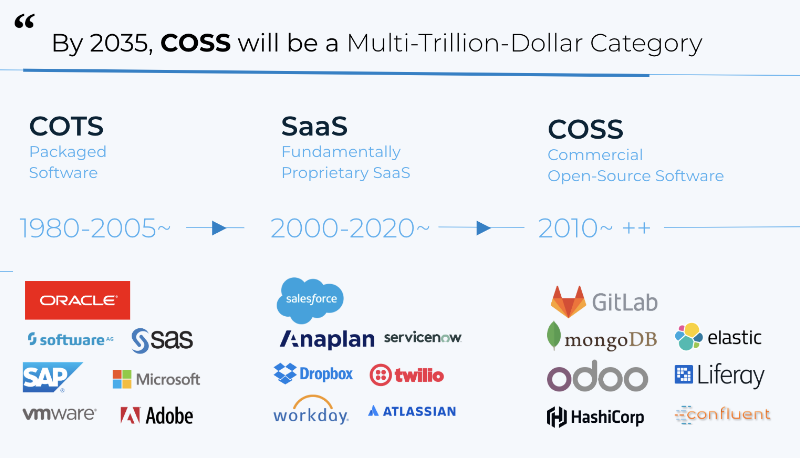

As usual, we end with this graphic depicting what we think the next Multi-Trillion-Dollar category in business will be:

COSS Weekly is brought to you via COSS Media, produced by OSS Capital (the first and only COSS-dedicated early-stage investor and platform for COSS founders.

Don't forget to sign-up for the second-annual FREE Open Core Summit 2020 Digital to meet with and learn from the leaders in COSS (enterprises, founders, investors, executives and more) on December 16-18th, 2020:

1 mission. 3 days. 10 tracks. 150+ speakers. 10,000+ attendees.

Top comments (0)